Real Estate 026: The Real Estate Advantage

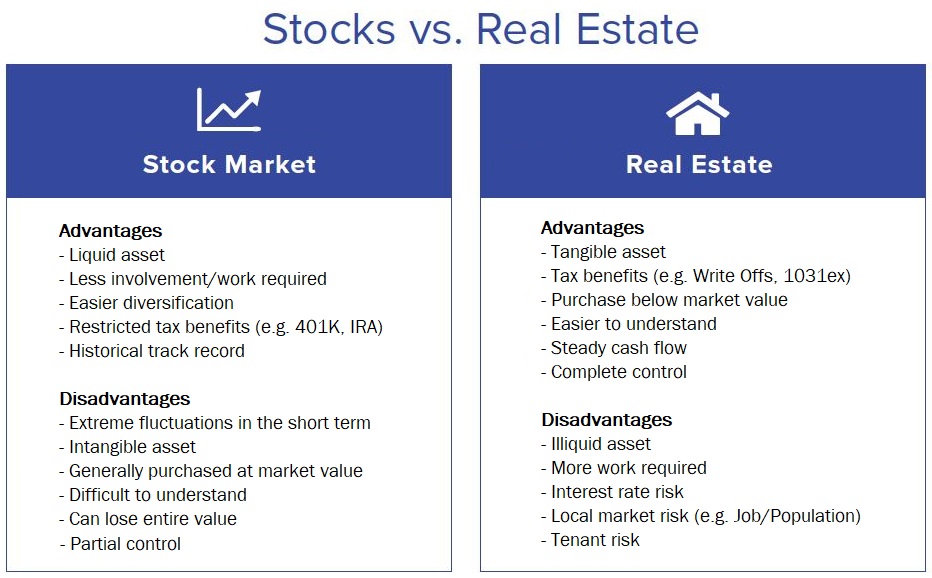

/When comparing different asset classes for investing long term, the most talked about classes that I have found, were stocks, bonds and real estate. Real estate is often viewed as a middle ground between the high volatility of the stock market and the low returns of the bond market. Stocks definitely have their advantages and disadvantages when put head to head against tangible rental real estate (e.g. Not REITs, private lending, notes, etc).

In my opinion, rental real estate is a far better way for the average person to become wealthy and retire early through the various tax advantages and steady cash flow that rental properties provide the landlord. Lets take a look at some of the pros and cons as listed below an discuss the key features:

Stock Market

Advantages

Liquidity: Stocks are a liquid asset, meaning that it is very easy for an investor to buy or sell parts of their portfolio, if not all, within a couple days (assuming its publicly trade).

Less work: Investors who typically invest through their retirement account have the option of choosing from a pool of funds pre-selected by the brokerage. This equates to less work in researching the underlying shares within a fund and looking into individual financial statements, their projected earnings, and other metrics.

Diversification: By investing in stocks, it is easy to pick and choose individual shares (slices of the pie) or purchase funds (whole pies) that have a mix of equity, large cap, small cap, international, and bonds (toppings and flavors) that provide diversification.

Disadvantages

Short Term Flux: Stocks are known to have extreme fluctuations in a relatively short period of time, and this can negatively impact an investor who is trying to live off of their investments during retirement. Further, for the average investor with limited resources, it is even more difficult to understand the reasoning behind the fluctuations and the internal/external influences that impact the value of a portfolio.

Market Value: Investments are typically made at market value or the trading price as the market is efficient, meaning that you cannot negotiate a discounted share or find a "distressed company." Although you can study the company and be a prudent investor in what you believe to be undervalued, there is also a chance it can plummet to zero.

Less control: An investor has the ability to pick their fund or individual stock, but they do not generally have a say in the day to day operations of the company. Shareholders with a significant position can choose the Board of Directors who oversee operations, but for the average investor, they are merely a passive investor that does not have control of the decision-making process.

Real Estate

Advantages

Tax Benefits: One of the largest benefits enjoyed by real estate owners is the numerous tax benefits currently in the IRS tax code. Write offs can relate to depreciation, maintenance and repairs, business travel & meals, mortgage interest, and many more. Further, you can defer the gains of the sale of one asset through a 1031 exchange into a new property.

Inefficient Market: The real estate market is inefficient compared to the stock market, and investors will always be able to find distressed property and motivated sellers (e.g. death, divorce, inheritance, exit strategy, etc.). This gives real estate investors the ability to find discounted properties and create equity through hard work.

Complete Control: With real estate, you are in complete control of the asset in terms of the purchase price, location, rent-to-value, choosing tenants, and exit strategy. You can choose to sell off your asset, 1031 exchange into a larger rental, or seller finance it to a tenant (lease option).

Disadvantages

Illiquid Asset: Once you have purchased a rental property, it is much more difficult to sell or transfer than a typical stock. Even for an all cash transaction, a typical escrow may take 7-14 days to close due to inspections, and other contingencies.

More Up-Front Work: Compared to purchasing stock through a fund, real estate requires you to do some research on the market, the team, and the property. With time, you can use your knowledge and streamline different processes or outsource the most of the work, however, getting to that point will require commitment from the investor.

Tenant Risk: Rental properties have tenants living in the units, as such, comes with added risk unseen in the stock market. You have to be well versed in the local laws and regulations to ensure that you are not exposing yourself to necessary lawsuits and liability.

The simply way I view investing in stock vs real estate is by looking at my competitive advantage. For me, I know that there are hundreds of smart, capable people on Wall Street with deep pockets and resources to out perform the average investor. On the flip side, real estate markets are local, meaning what happens in Los Angeles, doesn't necessarily impact Texas the same way, and vice versa. This allows an investor to choose where they want to compete (e.g. single family vs multifamily, A class vs C class neighborhoods, primary markets vs secondary markets) and avoid stiff competition.

As always, please make sure you do your due diligence and talk to your CPA/Attorney/Financial Adviser before making any investment decision.

Good luck!